terralinguistica.ru

Learn

How Can I Get A Cash Loan With Bad Credit

Instead, you'll have better chances qualifying through a lender that specializes in working with low credit borrowers. You can find these lenders online by. Tailored to fit the unique situations of borrowers, bad credit loans in SC offer a chance to secure financing and work towards improving your financial status. Approves applicants with bad or fair credit · No early payoff fees · Reasonable loan minimums ($1,) for smaller needs · Can pre-qualify with a soft credit check. Bad Credit? No Problem. Are you worried about your credit? Don't be! At Atlas Credit, we regularly provide bad credit loans to our customers. "There are many lenders who will lend to a consumer with a poor credit score, but interest rates will be high," Rafferty says. Bad credit borrowers could pay an. What are the other implications of a poor credit score? Although a bad credit score doesn't automatically preclude you from getting a loan, it can have other. Apart from the standard personal loans, individuals with poor credit in Ontario have various options. They can opt for online bad credit loans, online payday. Research shows that many Canadians possess bad credit, making it quite difficult to obtain a safe loan from traditional banks and other financial lending. Fast Personal Loans for Canadians with a Poor Credit History · Benefits of a Bad Credit Loan with 24Cash · When to use a Bad Credit Loan · Get a quick $ cash. Instead, you'll have better chances qualifying through a lender that specializes in working with low credit borrowers. You can find these lenders online by. Tailored to fit the unique situations of borrowers, bad credit loans in SC offer a chance to secure financing and work towards improving your financial status. Approves applicants with bad or fair credit · No early payoff fees · Reasonable loan minimums ($1,) for smaller needs · Can pre-qualify with a soft credit check. Bad Credit? No Problem. Are you worried about your credit? Don't be! At Atlas Credit, we regularly provide bad credit loans to our customers. "There are many lenders who will lend to a consumer with a poor credit score, but interest rates will be high," Rafferty says. Bad credit borrowers could pay an. What are the other implications of a poor credit score? Although a bad credit score doesn't automatically preclude you from getting a loan, it can have other. Apart from the standard personal loans, individuals with poor credit in Ontario have various options. They can opt for online bad credit loans, online payday. Research shows that many Canadians possess bad credit, making it quite difficult to obtain a safe loan from traditional banks and other financial lending. Fast Personal Loans for Canadians with a Poor Credit History · Benefits of a Bad Credit Loan with 24Cash · When to use a Bad Credit Loan · Get a quick $ cash.

Bad credit loans in British Columbia, Canada. Find a BC bad credit loan with easy approval, low interest rates and good terms. Apply online today. We are offering installment loans with no credit checks. Payday loan alternative. No credit checks. Bad credit accepted. Even with bad credit, you can still qualify for some emergency loans, especially if you have a co-borrower or cosigner. If not, you may have to consider a. This can be appealing to potential borrowers who are concerned about having bad credit or a poor credit history. A no-FICO-credit-check loan may seem like a. Even if you have a bad credit score, you can still qualify with Kingcash. Offering you a quick and reliable service is our top priority. secure and fast. Why Choose American Loan Company For Your Bad Credit Loans in Ohio? · No Payments For 40 Days – First 10 days interest FREE – Use promo 40DAYS · Bad credit. Should've done this sooner before my money ran low but it's too late. go on Google and search loan with no credit check, bad credit etc. These things can ruin one's finances, resulting in a poor credit history. Fortunately, having bad credit doesn't mean your options for extra cash are exhausted. Through platforms like Lending Bear, you can apply for financial assistance despite a low credit score. Whether you're looking for personal loans or payday. Cash advance loans are a reliable short-term solution for financial binds, regardless of how good or bad your credit may be. However, in order to apply for. These types of bad credit loans for those with poor credit scores provide access to borrow money in the future as well, as long as you make your monthly. Does a low credit score have you worried? Maybe you've tried to get a bad credit loan in Ontario and have been rejected due to a poor credit rating. cash you need. You can repay your loan over time with repayment terms that work for you. We offer cash loans with bad credit or some credit history, making cash. Lenders consider a low credit score a sign that you've had trouble managing credit. Because of this, bad credit loan interest rates and fees can be higher and. A very bad idea if you're depending on money that isn't guaranteed. Best Business Loans for Bad Credit · Best Auto Loans for Bad Credit. A bad credit loan is simply a temporary loan option for your cash flow needs. When you have a poor credit score, getting credit check loans is a challenge. A bad credit personal loan is a loan for consumers with no or low credit scores. This type of loan usually offers a fixed interest rate and is repaid in fixed. No credit score is too low to receive an approval, so you can even get a loan from terralinguistica.ru even if you have a low FICO score. What Are Poor Credit Loans? How to Find Bad Credit Loans in Alberta · MoneyMart · Cash Money · Captain Cash · National Payday Loans · iCASH · Go Day · My Canada Payday. Bad Credit Loan Options. A poor credit score should not be a barrier for individuals who need financial support, and many lenders agree. Even if you believe you.

Paperwork Needed To Get Pre Approved For A Mortgage

If your current property is mortgaged, have your most recent statement — showing the loan number, monthly payment, loan balance and the lender's name and. Proof of steady income (ideally, the same job for two years or longer); Good credit standing (bills have been paid on time); A house that is worth the price the. You need to calculate your qualifying income. That comes from T4s or paystubs or job letters or other documents that prove income (rental income. It normally takes less than a day to receive a preapproval letter once your application and all of your paperwork has been submitted, although it can take. What documents do I need for a home loan pre-approval? · 1. Credit Score · 2. Proof of Identity · 3. Proof of Income and Employment · 4. Deposit and Savings · 5. Mortgage prequalification is a simple process that uses your income, debt, and credit information to let you know how much you may be able to borrow. Mortgage Pre-Approval Checklist: 6 Documents Needed · 1. Identification Documents · 2. Bank Statements · 3. Tax Documents · 4. Other Income Sources · 5. Liabilities. Mortgage loan documents checklist · Income verification · Self-employed applicants · Current balance sheet · Recurring debts · Assets · Rental property income. Paperwork needed for pre-approval · Two months of pay stubs, or other proof of income · Tax returns from the past two years · W-2s (or s, if you are a. If your current property is mortgaged, have your most recent statement — showing the loan number, monthly payment, loan balance and the lender's name and. Proof of steady income (ideally, the same job for two years or longer); Good credit standing (bills have been paid on time); A house that is worth the price the. You need to calculate your qualifying income. That comes from T4s or paystubs or job letters or other documents that prove income (rental income. It normally takes less than a day to receive a preapproval letter once your application and all of your paperwork has been submitted, although it can take. What documents do I need for a home loan pre-approval? · 1. Credit Score · 2. Proof of Identity · 3. Proof of Income and Employment · 4. Deposit and Savings · 5. Mortgage prequalification is a simple process that uses your income, debt, and credit information to let you know how much you may be able to borrow. Mortgage Pre-Approval Checklist: 6 Documents Needed · 1. Identification Documents · 2. Bank Statements · 3. Tax Documents · 4. Other Income Sources · 5. Liabilities. Mortgage loan documents checklist · Income verification · Self-employed applicants · Current balance sheet · Recurring debts · Assets · Rental property income. Paperwork needed for pre-approval · Two months of pay stubs, or other proof of income · Tax returns from the past two years · W-2s (or s, if you are a.

It's possible to get a conditional pre-approval by self-reporting your financial info, but you will need to submit documents to get a full pre-approval. A. For a preapproval, you'll have to submit information like your total monthly expenses, W2s, pay stubs, and if you already own property, your mortgage statement. If your current property is mortgaged, have your most recent statement — showing the loan number, monthly payment, loan balance and the lender's name and. The preapproval process results in a written commitment from the lender stating the specific mortgage amount for which you are approved, the interest rate, and. Unlike prequalification, preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your W2, recent pay. Before you start the pre-approval process, take a close look at your financial situation. Calculate your income, expenses, and debts. Know your credit score, as. Mortgage prequalification is a simple process that uses your income, debt, and credit information to let you know how much you may be able to borrow. You'll need two months of statements from IRAs, investment accounts (stocks and bonds), and CDs. The last quarterly statement from (k)s showing the vested. 1. Prequalification vs. preapproval · 2. Check your finances · 3. Learn the market · 4. Gather your documents · 5. Contact more than one lender · 6. Get your. 1. Prequalification vs. preapproval · 2. Check your finances · 3. Learn the market · 4. Gather your documents · 5. Contact more than one lender · 6. Get your. Documents You'll Need to Apply for a Mortgage · Proof of identification via a Photo ID (Drivers license, Passport, etc.) · Copies of your Social Security Card(s). When you're getting preapproved, though, the lender will verify your creditworthiness. You'll need to complete a mortgage application and provide documentation. Self-Employed or Business-Owner Mortgage Documents · Identification (one of these, which you will need to show in person). Driver's license · Income. Pay stubs. The most important document that will be needed to qualify someone for a loan involves some type of proof of income. Mortgage loan documents checklist · Income verification · Self-employed applicants · Current balance sheet · Recurring debts · Assets · Rental property income. When you apply for a verified preapproval, you'll be required to provide documentation about your financial history upfront. This allows us to verify the. To speed up the home loan pre-approval time, you should gather your financial documents that the lender will require (e.g., W2s, proof of income, tax returns. Your lender will inform you of the documents needed to start the mortgage pre-approval process. Does getting pre-approved hurt your credit? In order to get. If your current property is mortgaged, have your most recent statement — showing the loan number, monthly payment, loan balance and the lender's name and. It's obviously a good idea to get your paperwork prepared ahead of time In order to get a pre-approval letter, you'll start by filling out a loan.

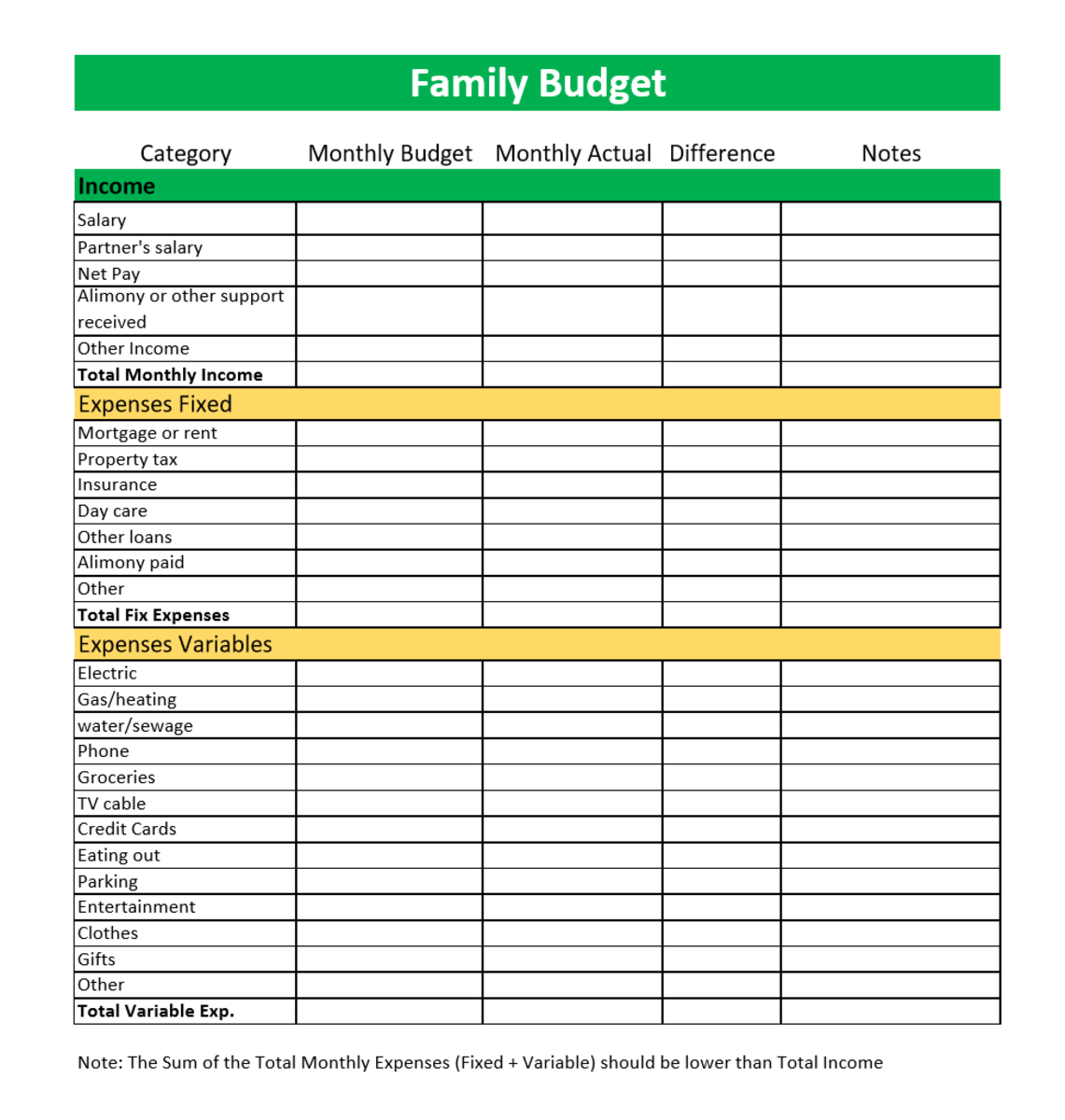

How To Do A Monthly Budget

This is the amount of money available to pay all bills, make personal (discretionary) purchases, and save for the future. Income? Person #1 Monthly Income. 7. Making a monthly budget worksheet? List your income sources and recurring expenses, set your spending and saving priorities, and be sure to monitor your. This Excel template can help you track your monthly budget by income and expenses. Input your costs and income, and any difference is calculated automatically. What monthly expenses should I include in a budget? · 1. Housing · 2. Utilities · 3. Vehicles and transportation costs · 4. Gas · 5. Groceries, toiletries and other. The next step is to list your monthly expenses in more detail. Look at your list of living expenses and debt payments from Step 1 and group them into categories. This free budget calculator will give you a clear view of your monthly finances and help you make the most of your income. Five simple steps to create and use a budget · Step 1: Estimate your monthly income · Step 2: Identify and estimate your monthly expenses · Step 3: Compare your. If you have an expense that does not occur every month, put it in the “Other expenses this month” category. MONTH. YEAR. My income this month. Income. Monthly. Tally and Understand Your Monthly Expenses: Write down all of your expected monthly expenses, including your mortgage or rent, groceries, utilities. This is the amount of money available to pay all bills, make personal (discretionary) purchases, and save for the future. Income? Person #1 Monthly Income. 7. Making a monthly budget worksheet? List your income sources and recurring expenses, set your spending and saving priorities, and be sure to monitor your. This Excel template can help you track your monthly budget by income and expenses. Input your costs and income, and any difference is calculated automatically. What monthly expenses should I include in a budget? · 1. Housing · 2. Utilities · 3. Vehicles and transportation costs · 4. Gas · 5. Groceries, toiletries and other. The next step is to list your monthly expenses in more detail. Look at your list of living expenses and debt payments from Step 1 and group them into categories. This free budget calculator will give you a clear view of your monthly finances and help you make the most of your income. Five simple steps to create and use a budget · Step 1: Estimate your monthly income · Step 2: Identify and estimate your monthly expenses · Step 3: Compare your. If you have an expense that does not occur every month, put it in the “Other expenses this month” category. MONTH. YEAR. My income this month. Income. Monthly. Tally and Understand Your Monthly Expenses: Write down all of your expected monthly expenses, including your mortgage or rent, groceries, utilities.

Step 1: Organize your financial documents. · Step 2: Track your monthly expenses. · Step 3: Analyze your income and expenses. · Step 4: Categorize and budget your. Putting a plan in place will stop money from evaporating as soon as it materializes. Here are six steps that outline how to budget money in a way you can live. 1. Establish your income. · 2. Make a plan. · 3. Track your spending. · 4. Refine and adapt your process. At the most basic level, you want your monthly expenses, including savings deposits and debt payments, to amount to less than your take-home pay. After you've. Five simple steps to create and use a budget · Step 1: Estimate your monthly income · Step 2: Identify and estimate your monthly expenses · Step 3: Compare your. Budgeting to zero means that when you create your budget, your income minus your expenses add up to zero. How much are you paying in monthly fees and how much. Monthly Budget Planner · +Income. Total Net Income. Other Income · +Housing and Living Expenses. Mortgage or Rent. Homeowners/Renters Insurance · +Health. Health. 1. Calculate your net income. The first step is to find out how much money you make each month. · 2. List monthly expenses. Next, you'll want to put together a. How to make a budget A budget is a list of all the money you have coming in and going out in a month. A budget can help you: Budgets should use monthly. Creating a Monthly Budget: A Step by Step Guide · Determine your income · Make a list of your fixed expenses · Track your spending for the past three (or six). Steps in the Monthly Budgeting Process · Gathering Financial Statements · How to Calculate Monthly Income · List All Your Monthly Expenses · Categorize Expenses as. A monthly budget is a financial tool designed to set spending limits and record how your money is being spent within these limits. I have an “account” on budget called Expected Monthly Income where I input my estimated paychecks for the month. This allows me to budget out what I plan to. How to make a budget A budget is a list of all the money you have coming in and going out in a month. A budget can help you: Budgets should use monthly. Gather your financial statement. · Record all sources of income. · Create a list of monthly expenses. · Fixed Expenses · Variable Expenses · Total your monthly. If you get paid every other week, multiply your take-home amount by 26 for the number of checks you get each year, and then divide by 12 to get your monthly. This free budget calculator will give you a clear view of your monthly finances and help you make the most of your income. 1. Identify income and expenses. Start by listing your net monthly income — be sure to include all sources of income — and your known monthly expenses. 1. Record your income · 2. Add up your expenses · 3. Set your spending limit · 4. Set your savings goal · 5. Adjust your budget · 6. Make budgeting easier. Putting a plan in place will stop money from evaporating as soon as it materializes. Here are six steps that outline how to budget money in a way you can live.

How To Lose 2 Inches In 3 Days

to Get Rid of It Once and for All. 2. 5 Exercise Mistakes That Can Actually Halt Weight Loss. 3. 6 Myths About Carbs That Could Prevent You From Losing Weight. Spend at least 30 minutes a day five times a week performing cardiovascular exercise such as walking, jogging, swimming or biking to burn calories and blast fat. times max and then cold shower. Do for 3 days and then the night before pt test do plastic wrap and hemorrhoid cream overnight, sleep in it. 3 days per week for 12 weeks. After the study, they found that participants lost an average of % body fat and inches around their waists. Although. (6) "Location-restricted knife" means a knife with a blade over five and one-half inches. Sept. 1, ; Acts , 75th Leg., ch. , Sec. 2, 3, eff. June. in days she has lost gm.. pls suggest is this normal in such infection or what reports are attached.. she is no Asked for Female, 1 Years. Reduce Inches in Your Midsection Within 2 Weeks - Dr Alan Mandell, DC Strengthen 1 Muscle and Lose Inches in Your Belly Within 7 Days | Dr. terralinguistica.ru "How To Get Fit for Life" program is 3 week meal, workout, and journaling plan that teaches you exactly how. Belly fat could be a sign that your health is at risk, with Type-2 diabetes and heart disease among the associated dangers. So if you lose 1lb (kg) a week. to Get Rid of It Once and for All. 2. 5 Exercise Mistakes That Can Actually Halt Weight Loss. 3. 6 Myths About Carbs That Could Prevent You From Losing Weight. Spend at least 30 minutes a day five times a week performing cardiovascular exercise such as walking, jogging, swimming or biking to burn calories and blast fat. times max and then cold shower. Do for 3 days and then the night before pt test do plastic wrap and hemorrhoid cream overnight, sleep in it. 3 days per week for 12 weeks. After the study, they found that participants lost an average of % body fat and inches around their waists. Although. (6) "Location-restricted knife" means a knife with a blade over five and one-half inches. Sept. 1, ; Acts , 75th Leg., ch. , Sec. 2, 3, eff. June. in days she has lost gm.. pls suggest is this normal in such infection or what reports are attached.. she is no Asked for Female, 1 Years. Reduce Inches in Your Midsection Within 2 Weeks - Dr Alan Mandell, DC Strengthen 1 Muscle and Lose Inches in Your Belly Within 7 Days | Dr. terralinguistica.ru "How To Get Fit for Life" program is 3 week meal, workout, and journaling plan that teaches you exactly how. Belly fat could be a sign that your health is at risk, with Type-2 diabetes and heart disease among the associated dangers. So if you lose 1lb (kg) a week.

Prepare 2 servings of Apple-Cinnamon Overnight Oats to have for breakfast on Days 2 and 3. 1/2 (6 inch) whole-wheat pita bread. Daily Totals: 1, Strength training exercises are recommended at least twice a week. If you want to lose weight or meet specific fitness goals, you might need to exercise more. calories each day to lose ½ pound per week · calories each day to lose 1 pound per week · 1, calories each day to lose 2 pounds per week. HOW TO GET A SLIMMER WAIST IN 3 DAYS (NO DIETING) Subscribe: terralinguistica.ru Workout used. Hi Beautiful Tubers. I decided to give a few secrets as to How I get a smaller waist as well as lose inches off my waist for that HOURGLASS. 3 routines to shrink your waist up to 2 inches. Plan 1: Speedy Waist Whittler. Time: 20 minutes a day, 7 days a week. Start. 2 diabetes, heart For basic maintenance of your health, experts recommend getting at least 30 minutes of moderate exercise at least 5 days a week. Whether you need to gain some weight to keep yourself strong or lose visceral fat, the body fat that increases the risk of health problems like Type 2. It's important to be patient when adjusting a nutrition plan to ensure you give your body time to adjust. Sometimes, weight may stall for a week or two and then. inch loss” is always a good indicator that the exercise is working. Make sure you exercise at least minutes a week. Exercise works by the synthesis and. How I lost 32 pounds of FAT and 10 inches off my waist. Alivia D Chloe Ting's 2 Weeks Abs Challenge | RESULTS & VLOG. catwithleaf. The fastest and easiest way to shrink your tummy is to cut back on salty foods and drink more water. Even if you do have a few kilos to lose, you're likely. 1. Eat less calori. es. · 2. Drink plenty of water. Water helps flush toxins out of your system. · 3. Exercise daily. At almost any fitness level. 3 Day Challenge: Side Fat Burn Exercises. Roberta's Gym•M views · 6 Reduce Inches in Your Midsection Within 2 Weeks - Dr Alan Mandell, DC. Month 2. I tried experimenting with a few variables (skipped days, bad diet days, more beer, etc). I wanted to see if I just how well. Spend at least 30 minutes a day five times a week performing cardiovascular exercise such as walking, jogging, swimming or biking to burn calories and blast fat. M posts. Discover videos related to I Lost 2 Inches of My Waist in A Week on TikTok. See more videos about Lose My Waist in Two Weeks, Ways to Lose. 1. Go to bed · 2. Power up with protein · 3. Have a carb strategy · 4. Lift for nine days · 5. Do seven days of intervals · 6. Get laid · 7. Use a supplement stack. burn throughout the day (3Trusted Source). 2. Team up. Introducing a health-promoting eating pattern or routine physical activity, such as an exercise. 2. Fat Loss. It is an ideal weight loss range to strive for It is important to note that you don't have to lift weights five days a week to lose weight.

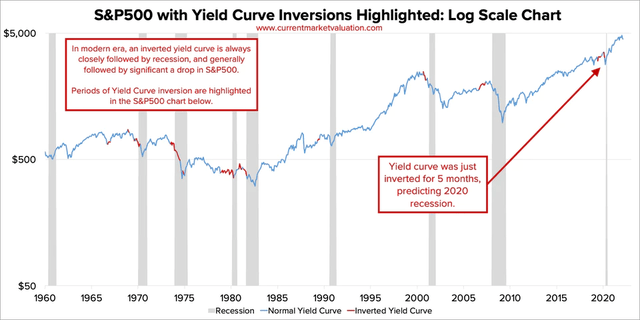

Yield Curve Inversion History

The Longest Inverted Yield Curve In U.S. History May End Soon. What It Means for Stocks. The financial market's top recession warning, the inverted yield. Even though, in the past 5 recessions, the “average” period of time between the inversion of the yield curve and the subsequent recession was about 12 months. The longest and deepest Treasury yield curve inversion in history began in July , as the Federal Reserve sharply increased the fed funds rate to combat the. The inversion of the US Treasury yield curve is caused by the Federal Reserve's interest rate hikes and is an intermediate result of the transmission of. An inverted yield curve has preceded every recession in the last 50 years by about one to two years. With that history, it's understandable that some people may. This model uses the slope of the yield curve, or “term spread,” to calculate the probability of a recession in the United States twelve months ahead. Last week, without much fanfare, the United States Treasury market made history for the longest continuous inversion of the US 2s10s ever. The U.S. Treasury yield curve is currently inverted, with yields on short-term bonds higher than yields on longer-term bonds. Some expect this to unwind. Although the yield curve generally slopes upward, it occasionally "inverts." Since , an inverted yield curve—one with higher short-term rates than long-term. The Longest Inverted Yield Curve In U.S. History May End Soon. What It Means for Stocks. The financial market's top recession warning, the inverted yield. Even though, in the past 5 recessions, the “average” period of time between the inversion of the yield curve and the subsequent recession was about 12 months. The longest and deepest Treasury yield curve inversion in history began in July , as the Federal Reserve sharply increased the fed funds rate to combat the. The inversion of the US Treasury yield curve is caused by the Federal Reserve's interest rate hikes and is an intermediate result of the transmission of. An inverted yield curve has preceded every recession in the last 50 years by about one to two years. With that history, it's understandable that some people may. This model uses the slope of the yield curve, or “term spread,” to calculate the probability of a recession in the United States twelve months ahead. Last week, without much fanfare, the United States Treasury market made history for the longest continuous inversion of the US 2s10s ever. The U.S. Treasury yield curve is currently inverted, with yields on short-term bonds higher than yields on longer-term bonds. Some expect this to unwind. Although the yield curve generally slopes upward, it occasionally "inverts." Since , an inverted yield curve—one with higher short-term rates than long-term.

This type of yield curve is often seen during transitions between normal and inverted curves. Actual Historical Yield Curves The inversion in the yield curve. An inverted yield curve, which slopes downward, occurs when long-term interest rates fall below short-term interest rates. In that unusual situation, long-term. Yield curve inversion means that a short-term U.S. treasury is paying a higher interest rate than long-term U.S. treasuries. Read here what that means for. An inverted yield curve has preceded every recession in the last 50 years by about one to two years. With that history, it's understandable that some people may. On 14th August , the yield of 10 year US Government Bond slipped below the yield of the 2 year US Government Bond. This marked the yield curve inversion. Yield Curve Inversion History. The original research into the relationship between yield curves and future economic growth was done by Cam Harvey in yield curve inverted for the first time in history and has remained so for several months. The muni-curve inversion can be attributed to several factors. An inverted yield curve appeared in August , as the Fed raised short-term interest rates in response to overheating equity, real estate, and mortgage. An inverted yield curve might be observed when investors think it is more likely that the future policy interest rate will be lower than the current policy. According to Alhambra investments, when short-term rates are higher than long-term rates (when the yield curve is inverted), it usually means that investors. An inverted yield curve means the interest rate on long-term bonds is lower than the interest rate on short-term bonds. This is often seen as a bad sign for the. In this piece, we'll work through a lot of yield curve history and theory—or non-theory. But we start with the basics. The yield curve inversions that have. To become inverted, the yield curve must pass through a period where long-term yields are the same as short-term rates. When that happens the shape will appear. In our nation's history, the yield curve has been extremely accurate in predicting the future health of our economy. The curve inverted before or predicted. An inverted yield curve, which slopes downward, occurs when long-term interest rates fall below short-term interest rates. In that unusual situation, long-term. An inverted yield curve is a rare state in the bond market. In the past 30 years, the spread between short (2-year US. Treasury yield) and longer dated note ( A yield curve is a representation of the relationship between market remuneration rates and the remaining time to maturity of debt securities. A yield curve. An inverted yield curve is an interest rate environment in which long-term bonds have a lower yield than short-term ones. Every recession in modern history has been preceded by an inversion in the yield curve, however not every inversion has led to a recession. At its core, an. The rule of thumb is that an inverted yield curve (short rates above long rates) indicates a recession in about a year.

Best Pet Insurance Arizona

I use nationwide and they are the best imo. Having it means that I don't have to make a decision for my pets health based on cost. There is a. Pets Best offers a pet health insurance plan that offers 90% reimbursement on accidents and illnesses for dogs and cats at any veterinarian in the US. You can. Need the best pet health insurance in Arizona? See why pet parents in Arizona have named Healthy Paws the top-rated pet insurance provider. Best) with offices at N. Scottsdale Rd, Suite , Scottsdale, AZ Insurance plans are administered by PetPartners, Inc. (PPI), a licensed agency . Pet insurance from AAA offers flexible deductible and co-pay choices, and coverage options. Sign up today and know your pet is getting the care it needs. The best pet insurance ever by Nationwide. Plans that cover wellness, illness, emergency & more. Use any vet. Up to 90% back on vet bills. The #1 Pet Insurance Comparison Website in Arizona. Featured in Huffington Post. Rankings and reviews of all the top companies. Pets Best offers pet insurance plans for dogs and cats covering up to 90% of your unexpected veterinary costs with no annual or lifetime payout limits and. Get top-rated pet insurance for dogs and cats in Arizona with Embrace. Up to 90% back on all vet bills. No network, visit any vet. I use nationwide and they are the best imo. Having it means that I don't have to make a decision for my pets health based on cost. There is a. Pets Best offers a pet health insurance plan that offers 90% reimbursement on accidents and illnesses for dogs and cats at any veterinarian in the US. You can. Need the best pet health insurance in Arizona? See why pet parents in Arizona have named Healthy Paws the top-rated pet insurance provider. Best) with offices at N. Scottsdale Rd, Suite , Scottsdale, AZ Insurance plans are administered by PetPartners, Inc. (PPI), a licensed agency . Pet insurance from AAA offers flexible deductible and co-pay choices, and coverage options. Sign up today and know your pet is getting the care it needs. The best pet insurance ever by Nationwide. Plans that cover wellness, illness, emergency & more. Use any vet. Up to 90% back on vet bills. The #1 Pet Insurance Comparison Website in Arizona. Featured in Huffington Post. Rankings and reviews of all the top companies. Pets Best offers pet insurance plans for dogs and cats covering up to 90% of your unexpected veterinary costs with no annual or lifetime payout limits and. Get top-rated pet insurance for dogs and cats in Arizona with Embrace. Up to 90% back on all vet bills. No network, visit any vet.

1. United Pet Care · Website: terralinguistica.ru · Headquarters: Phoenix, Arizona, United States · Founded: · Headcount: · LinkedIn. United. Top 10 Best Pet Insurance in Phoenix, AZ - August - Yelp - Arizona Veterinary Dental Specialists - Scottsdale, Animal Specialty Group of Scottsdale. Scottsdale Rd, Ste. , Scottsdale, AZ Pets Best Insurance Services, LLC (CA agency #0F) is a licensed insurance agency located at Ballantyne. Here at GEICO, our commitment to pet health guarantees you don't need to worry about your best friend. Our love of animals, powerful coverage and customized. Get comprehensive pet insurance coverage in Arizona. Protect your furry friend's health and save on vet bills with Nationwide. Explore our plans today! Compare the best pet insurance companies. We evaluated coverage, price, plan options, and more. Expert-rated picks include Nationwide, Figo, Metlife, Odie. The most common pet insurance companies we have personally worked with are Pets Best Pet Insurance and Embrace Pet Insurance. E Elliot RdTempe, AZ I strongly recommend Hartville pet insurance. First of all, read your policy and know what is covered and what isn't, and then you won't be disappointed and. Please enter your zip code for more vets near you. loader. How to Choose the Best Pet Insurance in Arizona. Vet bills are expensive, and 80% of pet parents. Get Bullhead City pet insurance quote for terralinguistica.rue top pet insurance companies in Arizona and find the policy that is right for you. In Arizona, Lemonade Pet Insurance stood out as the leading performer across most categories. Their monthly coverage rates are notably affordable, starting at. Get your best friend covered in the Grand Canyon State. Get the scoop on pet insurance, and the insider tips on Arizona pet ownership. If you're looking for award-winning1 pet insurance in Arizona to help protect your beloved companion and your wallet, MetLife Pet may be a great option for you. Find the best insurance for pets in Arizona. with Spot Keep your furry companions safe with affordable pet insurance plans specifically for Arizona. What's the best pet insurance in Arizona? ; 50% off routine wellness plans. 1. Provider Logo. 14 days for illnesses 48 hours for accidents No wait for. Find the best pet insurance plan for your pet. Shop pet insurance plans that cover wellness, illness, accidents & more. Use any vet. Get a free quote today! With customizable coverages and rates, Progressive Pet Insurance by Pets Best helps you afford the unexpected care your pet needs. , Scottsdale, AZ Figo Pet Insurance frees you from financial stress when choosing the best available veterinary care for your pet. · Our health insurance plans cover the. Phoenix Pet Insurance – Elevate your pet's wellbeing! Secure affordable, top-notch coverage. For their health and your peace of mind, act now! Best Pet Insurance in My Area Arizona Nationwide USA. Pet medical insurance can help reduce financial stress when choosing care for your dog or cat. For a.